new mexico gross receipts tax table 2021

The state of New Mexico is benefiting from the over-collection of gross receipts tax I believe. As of 2021 New Mexicos gross domestic product was over 95 billion.

News Alerts Taxation And Revenue New Mexico

Listing Agreement Exclusive Right to Sell for the listing REALTOR to fill in so that the proper amount of Gross Receipts Tax is computed and collected by the title company.

. Subsequently the assessment in New Jersey began to sunset in 2006. The tax is imposed on the seller but it is common for the seller to pass the tax on to the purchaser. Crescimento económico em África.

Taxpayers should be aware that subsequent legislation regulations court. It sadly goes beyond New Mexico taxing social security benefits on top of federal tax. Municipalities may assess an additional gross receipts tax resulting in rates between 5375 and 88625.

New Mexico imposes a gross receipts tax of 5 on most retail sales or leasing of property or performance of services in New Mexico. Continue to use any Federal Form W-4 for New Mexico withholding but the 2021 New Mexico state withholding tables found in this publication should be used. This publication contains general information on the New Mexico withholding tax and tax tables for the percentage method of withholding.

Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes. Delaware Oregon and Tennessee have gross receipts taxes in addition to corporate income taxes as do several states like Pennsylvania Virginia and West. If applicable you may also claim the refundable portion of approved tax credits using this schedule.

Corruption perception index by transparency international 2010-2012 Figura 11. The state rate is 5125. See Table 18 for more information.

In New Jersey calls to repeal the tax grew less than a year after it came into effect due to the perceived lack of fairness as the tax applied to businesses unequally. New Mexico imposes a Gross Receipts Tax GRT on many transactions which may even include some governmental receipts. The gross receipts taxes created economic problems for enacting states.

The period during which there is a significant decline in gross receipts ends with the earlier of January 1 2021 or the calendar quarter that follows the first calendar quarter in which the employers 2020 quarterly gross receipts are greater than 80 percent of its gross receipts for the same calendar quarter in 2019. A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR Form 1106. The maximum local tax rate allowed by New.

On your TRD-41413 Gross Receipts Tax Return line 2 enter the total tax credits you claimed on line A of this schedule to apply to tax due. Normally the provider or seller passes the tax on to the. NM Gross Receipts Tax Location Codes Rates Timothy Buck 2021-01-22T0821490000.

Total tax revenue as a percentage of GDP indicates the share of a countrys output that is collected by the government through taxes. New Mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933. Summary of external financial flows and tax receipts in Africa 2000-12 2012 Table 53.

We have a statewide. Use this schedule to claim the business-related tax credits listed on this form that you may take against New Mexico gross receipts tax. Effective July 1 2021 New Mexico required online servicessellers to.

A Nevada Ohio Texas and Washington do not have a corporate income tax but do have a gross receipts tax with rates not strictly comparable to corporate income tax rates. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that ranges from 0 to 9062 across the state with an average local tax of 2257 for a total of 7382 when combined with the state sales tax. This resembles a sales tax but unlike the sales taxes in many states it applies to services as well as tangible goods.

Private practice doctors such as myself must pay gross receipts tax for medical services.

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

Notarized Letter Template Word Beautiful Affidavit Form Notary Template Word Wc Printable Letter Templates Letter Template Word Free Printable Letter Templates

Gross Receipts Location Code And Tax Rate Map Governments

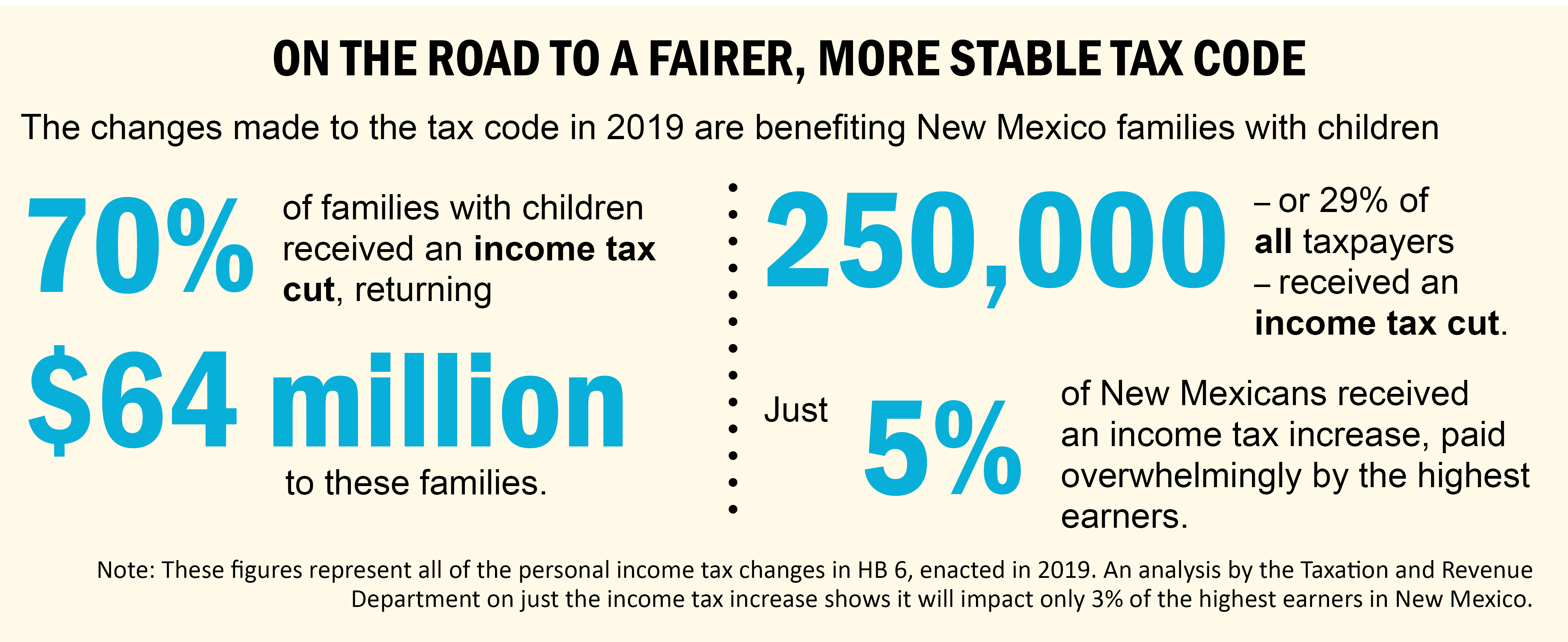

A Guide To New Mexico S Tax System New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

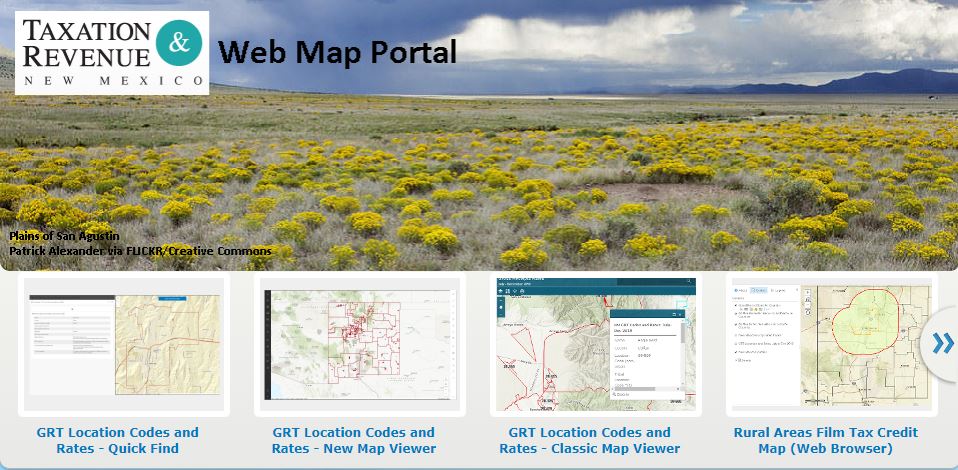

Nm Gross Receipts Tax Location Codes Rates New Mexico Association Of Realtors